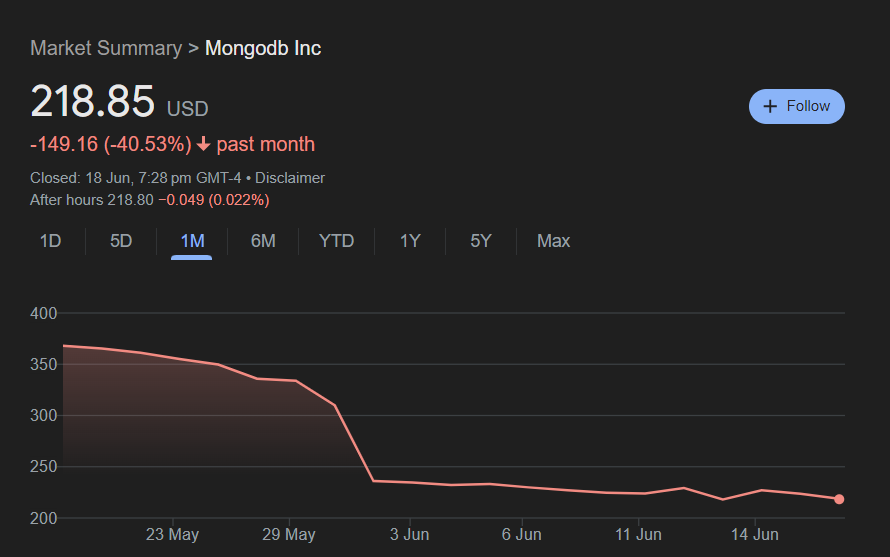

MongoDB, Inc. (NASDAQ) shareholders have faced a significant setback with a 41% drop in share price over the last month. This decline has contributed to a 42% decrease over the past year, making it a tough period for investors.

Despite this price dip, MongoDB still has a high price-to-sales (P/S) ratio of 9.1x compared to the IT industry average of below 1.8x. This could make investors wary, but it’s essential to dig deeper to understand if this high P/S ratio is justified.

Understanding MongoDB’s P/S Ratio

MongoDB’s high P/S ratio suggests that the market expects its revenue growth to continue at a strong pace. If these expectations aren’t met, investors might find themselves paying too much for the stock.

Revenue Growth and Future Projections

MongoDB has shown impressive revenue growth, increasing by 29% over the last year and 175% over the past three years. Analysts predict that revenue will continue to grow by 20% annually over the next three years, outpacing the industry average of 11% per year. This anticipated growth helps justify the elevated P/S ratio.

Despite the recent drop in share price, MongoDB’s P/S ratio remains high due to its strong revenue growth prospects. Investors seem confident in the company’s future performance, which supports the current valuation. Given these circumstances, a significant drop in share price seems unlikely in the near term.

However, it’s important to be aware of potential risks. For more detailed information, you might want to explore the 3 warning signs for MongoDB that we’ve identified. Additionally, it could be helpful to look at other profitable companies with strong earnings growth and reasonable P/E ratios.